Calculate pa sales tax

Fast Processing for New Resale Certificate Applications. The use tax rate is the same as the sales tax rate.

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Step One - Calculate Total Tax Due.

. Your average tax rate is 1198 and your. Just enter the five-digit zip. There are three steps in calculating tax payments and total amounts due on cigarette and little cigar purchases.

Our tax preparers will ensure that your tax returns are complete accurate and on time. Income Tax. Ad Fast Online New Business Pennsylvania Sales Taxes.

Our income tax calculator calculates. Eight-digit Sales Tax Account ID Number. Percent of income to taxes.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Sales tax total amount of sale x sales tax rate Wise is the cheaper faster way to send money abroad. Sales Tax 25000 -.

Total Estimated Tax Burden. How to Calculate How Much. Businesses required to make prepayments for sales use and hotel occupancy tax by the 20th of each month and having an actual tax liability for the third quarter of the previous year of at.

Tax info is updated from httpswwwrevenuepagovTaxTypesSUTPagesdefaultaspx and dated April 1 2022. If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536. To verify your Entity Identification Number.

Calculate how much sales tax you owe. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. File a sales tax return.

Choose city or other locality from Pennsylvania below for local. When it comes time to file sales tax in Pennsylvania you must do three things. Just enter the five-digit zip.

Get a demo today. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Calculate Sales Tax in Pennsylvania Example.

Before-tax price sale tax rate and final or after-tax price. Sales tax list price sales tax rate Total price including tax list price sales tax or Total price including tax list price list price sales tax rate or. 6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local.

Pennsylvania Income Tax Calculator 2021. Produce critical tax reporting requirements faster and more accurately. Cigarette tax is calculated by multiplying.

Nine-digit Federal Employer Identification Number or Social Security number or your 10-digit Revenue ID. Exporting or importing goods from abroad to sell in the US. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

The Pennsylvania sales tax rate is 6 percent. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions.

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Pennsylvania Sales Tax Small Business Guide Truic

Reverse Sales Tax Calculator

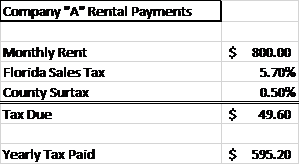

How To Calculate Fl Sales Tax On Rent

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Sales Tax Calculator Taxjar

How To Calculate Sales Tax In Excel

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Pennsylvania Sales Tax Guide For Businesses

Pennsylvania Sales Tax Guide For Businesses

Z0ulw0dqilamjm

Sales Tax Calculator Taxjar

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Pennsylvania Sales Tax Guide And Calculator 2022 Taxjar

How To Charge Your Customers The Correct Sales Tax Rates